Multiple Choice

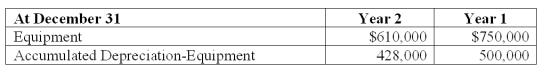

Sebring Company reports depreciation expense of $40,000 for Year 2. Also, equipment costing $140,000 was sold for a $5,000 gain in Year 2. The following selected information is available for Sebring Company from its comparative balance sheet. Compute the cash received from the sale of the equipment.

A) $23,000.

B) $33,000.

C) $28,000.

D) $40,000.

E) $68,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: The statement of cash flows is divided

Q22: Cash paid for merchandise is an operating

Q43: The indirect method separately lists each major

Q77: The appropriate section in the statement of

Q79: When analyzing the changes on a spreadsheet

Q83: Use the following calendar-year information to prepare

Q104: A main purpose of the statement of

Q114: Hancock reported assets of $13,362 million at

Q126: _ activities generally include those transactions and

Q202: A cash-based measure to help business decision