Multiple Choice

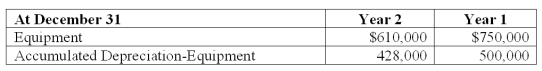

Sebring Company reports depreciation expense of $40,000 for Year 2. Also, equipment costing $140,000 was sold for a $10,000 loss in Year 2. The following selected information is available for Sebring Company from its comparative balance sheet. Compute the cash received from the sale of the equipment.

A) $62,000.

B) $38,000.

C) $28,000.

D) $18,000.

E) $58,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: The direct method for preparing and reporting

Q28: The first line item in the operating

Q38: Analysis reveals that a company had a

Q128: The cash flow on total assets ratio

Q147: The statement of cash flows helps address

Q148: A company's income statement showed the following:

Q159: Which one of the following is representative

Q167: The accounting principle that requires important noncash

Q194: Investing activities include: (a) the purchase and

Q211: The purchase of stock in another company