Not Answered

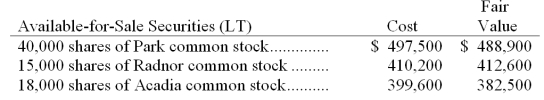

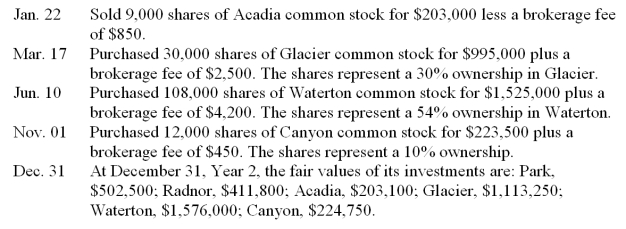

Eaton Company had the following long-term available-for-sale securities in its portfolio at December 31, Year 1. Eaton had several long-term investment transactions during the next year. After analyzing the effects of each transaction, (1) determine the amount Eaton should report on its December 31, Year 1 balance sheet for its long-term investments in available-for-sale securities, (2) determine the amount Eaton should report on its December 31, Year 2 balance sheet for its long-term investments in available-for-sale securities, (3) prepare the necessary adjusting entry to record the fair value adjustment at December 31, Year 2.

Correct Answer:

Verified

Correct Answer:

Verified

Q45: Wiffery Company had the following trading securities

Q47: Chung owns 40% of Lu's common stock.

Q50: When using the equity method for investments

Q51: All of the following statements regarding equity

Q54: A company has net income of $130,500.

Q97: Long-term investments in available-for-sale securities are reported

Q104: Cash equivalents are investments that are readily

Q113: Long-term investments in debt securities not classified

Q154: At acquisition,debt securities are:<br>A)Recorded at their cost,

Q176: Profit margin is net sales divided by