Not Answered

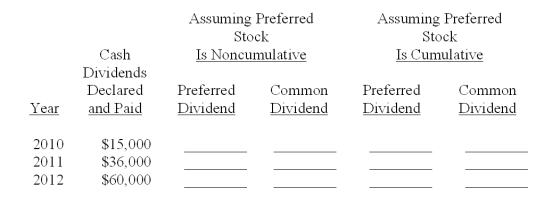

A company was organized in January 2010 and has 2,000 shares of $100 par value, 10%, nonparticipating preferred stock outstanding and 30,000 shares of $10 par value common stock outstanding. It has declared and paid cash dividends each year as shown below. Calculate the total dividends distributed to each class of stockholder under each of the assumptions given.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: A company declared a $0.55 per share

Q19: A company has 1,000 shares of $50

Q35: The least amount that the buyers of

Q40: The _ protects stockholders' proportional interest in

Q41: Explain how to compute book value per

Q67: No-par stock to which the directors assign

Q71: The term restricted retained earnings refers to

Q100: Changes in accounting estimates are accounted for

Q138: Explain how to compute dividend yield and

Q174: A stock dividend decreases the market price