Multiple Choice

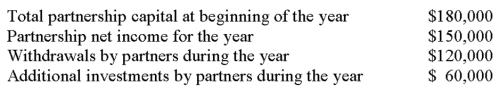

The following information is available on Stewart Enterprises, a partnership, for the most recent fiscal year:  There are three partners in Stewart Enterprises: Stewart, Tedder and Armstrong. At the end of the year, the partners' capital accounts were in the ratio of 2:1:2, respectively. Compute the ending capital balances of the three partners.

There are three partners in Stewart Enterprises: Stewart, Tedder and Armstrong. At the end of the year, the partners' capital accounts were in the ratio of 2:1:2, respectively. Compute the ending capital balances of the three partners.

A) Stewart = $108,000; Tedder = $54,000; Armstrong = $108,000.

B) Stewart = $90,000; Tedder = $90,000; Armstrong = $90,000.

C) Stewart = $204,000; Tedder = $102,000; Armstrong = $204,000.

D) Stewart = $84,000; Tedder = $102,000; Armstrong = $84,000.

E) Stewart = $60,000; Tedder = $30,000; Armstrong = $60,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Conley and Liu allow Lepley to purchase

Q22: Paco and Kate invested $99,000 and $126,000,

Q37: Collins and Farina are forming a partnership.

Q50: _ implies that each partner in a

Q60: When the current value of a partnership

Q70: If partners devote their time and services

Q110: Partners' withdrawals are credited to their separate

Q118: In a limited partnership the general partner

Q126: The equity section of the balance sheet

Q133: Nee High and Low Jack are partners