Not Answered

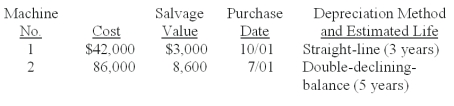

A company's property records revealed the following information about its plant assets:  Calculate the depreciation expense for each machine for the year ended December 31 for Year 1, and for the year ended December 31 for Year 2.

Calculate the depreciation expense for each machine for the year ended December 31 for Year 1, and for the year ended December 31 for Year 2.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q5: _ refers to the insufficient capacity of

Q16: Betterments:<br>A) Are expenditures making a plant asset

Q21: On July 1 of the current year,

Q29: Once the estimated depreciation expense for an

Q43: Plant assets refer to intangible assets that

Q57: Plant assets are used in operations and

Q100: A patent is an exclusive right granted

Q153: Thomas Enterprises purchased a depreciable asset on

Q193: A company purchased and installed a machine

Q203: A depreciation method in which a plant