Multiple Choice

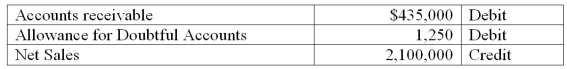

A company uses the percent of receivables method to determine its bad debts expense. At the end of the current year, the company's unadjusted trial balance reported the following selected amounts:  All sales are made on credit. Based on past experience, the company estimates 3.5% of credit sales to be uncollectible. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

All sales are made on credit. Based on past experience, the company estimates 3.5% of credit sales to be uncollectible. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

A) Debit Bad Debts Expense $13,975; credit Allowance for Doubtful Accounts $13,975.

B) Debit Bad Debts Expense $15,225; credit Allowance for Doubtful Accounts $15,225.

C) Debit Bad Debts Expense $16,475; credit Allowance for Doubtful Accounts $16,475.

D) Debit Bad Debts Expense $7,350; credit Allowance for Doubtful Accounts $7,350.

E) Debit Bad Debts Expense $17,350; credit Allowance for Doubtful Accounts $17,350.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: A company reports the following results in

Q13: A company borrowed $1,000 by signing a

Q15: MixRecording Studios purchased $7,800 in electronic components

Q27: On August 9, Pierce Company receives a

Q57: The _ methods use balance sheet relations

Q59: A company borrowed $10,000 by signing a

Q84: Since pledged accounts receivables only serve as

Q109: A company factored $35,000 of its accounts

Q124: The maturity date of a note receivable:<br>A)

Q137: When the maker of a note honors