Short Answer

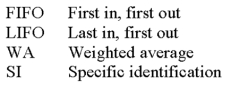

Identify the inventory valuation method that is being described for each situation below. In all cases, assume a period of rising prices. Use the following to identify the inventory valuation method:  a. The method that can only be used if each inventory item can be matched with a specific purchase and its invoice.

a. The method that can only be used if each inventory item can be matched with a specific purchase and its invoice.

b. The method that will cause the company to have the lowest income taxes.

c. The method that will cause the company to have the lowest cost of goods sold.

d. The method that will assign a value to inventory that approximates its current cost.

e. The method that will tend to smooth out erratic changes in costs.

Correct Answer:

Verified

a. SI

b. L...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b. L...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q94: The consistency concept:<br>A) Prescribes a company to

Q103: Whether purchase costs are rising or falling,

Q107: A company can change its inventory costing

Q114: Explain how the inventory turnover ratio and

Q149: The retail inventory method estimates the cost

Q174: The reasoning behind the retail inventory method

Q175: An overstatement of ending inventory will cause

Q181: Using the information given below, prepare general

Q182: Georgia Peach Company reported net sales in

Q189: A company's cost of inventory was $317,500.