Not Answered

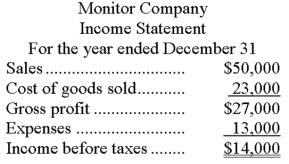

Monitor Company uses the LIFO method for valuing its ending inventory. The following financial statement information is available for its first year of operation:  Monitor's ending inventory using the LIFO method was $8,200. Monitor's accountant determined that had the company used FIFO, the ending inventory would have been $8,500.

Monitor's ending inventory using the LIFO method was $8,200. Monitor's accountant determined that had the company used FIFO, the ending inventory would have been $8,500.

a. Determine what the income before taxes would have been, had Monitor used the FIFO method of inventory valuation instead of LIFO.

b. What would be the difference in income taxes between LIFO and FIFO, assuming a 30% tax rate?

c. If Monitor wanted to lower the amount of income taxes to be paid, which method would it choose?

Correct Answer:

Verified

Correct Answer:

Verified

Q27: A company has inventory of 10 units

Q40: Gotham Company reported a December 31 ending

Q48: In applying the lower of cost or

Q73: Evaluate each inventory error separately and determine

Q77: Interim statements:<br>A) Are required by the Congress.<br>B)

Q78: For Randy Hetrick of Fitness Anywhere, the

Q105: Incidental costs often added to the costs

Q161: An error in the period-end inventory balance

Q184: The reliability of the gross profit method

Q185: When taking a physical count of inventory,