Not Answered

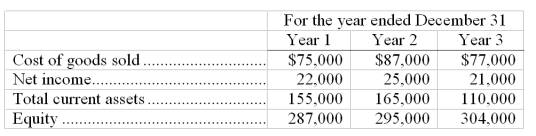

The City Store reported the following amounts on their financial statements for Year 1, Year 2, and Year 3:  It was discovered early in Year 4 that the ending inventory on December 31, Year 1 was overstated by $6,000, and the ending inventory on December 31, Year 2 was understated by $2,500. The ending inventory on December 31, Year 3 was correct. Ignoring income taxes determine the correct amounts of cost of goods sold, net income, total current assets, and equity for each of the years Year 1, Year 2, and Year 3.

It was discovered early in Year 4 that the ending inventory on December 31, Year 1 was overstated by $6,000, and the ending inventory on December 31, Year 2 was understated by $2,500. The ending inventory on December 31, Year 3 was correct. Ignoring income taxes determine the correct amounts of cost of goods sold, net income, total current assets, and equity for each of the years Year 1, Year 2, and Year 3.

Correct Answer:

Verified

Correct Answer:

Verified

Q86: Costs included in the Merchandise Inventory account

Q107: A company can change its inventory costing

Q130: _ is the estimated sales price of

Q135: The inventory turnover ratio is computed by

Q143: Damaged and obsolete goods that can be

Q174: Use the following information for Razor Company

Q176: A company made the following merchandise purchases

Q179: A company uses the retail inventory method

Q181: Using the information given below, prepare general

Q182: Georgia Peach Company reported net sales in