Not Answered

Based on the unadjusted trial balance for Bella's Beauty Salon and the adjusting information given below, prepare the adjusting journal entries for Bella's Beauty Salon.

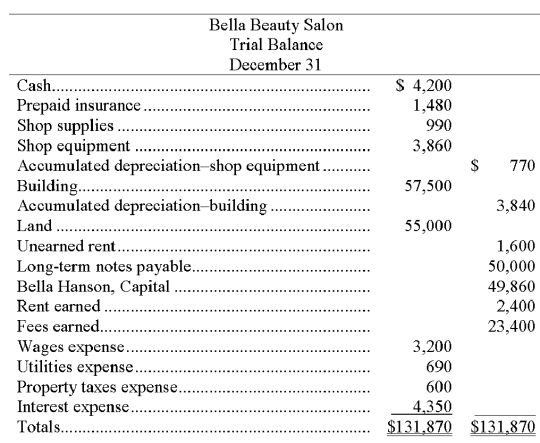

Bella Beauty Salon's unadjusted trial balance for the current year follows:  Additional information:

Additional information:

a. An insurance policy examination showed $1,240 of expired insurance

b. An inventory count showed $210 of unused shop supplies still available.

c. Depreciation expense on shop equipment, $350.

d. Depreciation expense on the building, $2,220.

e. A beautician is behind on space rental payments, and this $200 of accrued revenues was unrecorded at the time the trial balance was prepared.

f. $800 of the Unearned Rent account balance was earned by year-end.

g. The one employee, a receptionist, works a five-day workweek at $50 per day. The employee was paid last week but has worked four days this week for which she has not been paid.

h. Three months' property taxes, totaling $450, have accrued. This additional amount of property taxes expense has not been recorded

i. One month's interest on the note payable, $600, has accrued but is unrecorded.

Correct Answer:

Verified

Correct Answer:

Verified

Q121: A trial balance prepared after adjustments have

Q131: An adjusting entry often includes an entry

Q140: A company purchased a new truck at

Q140: Accrued expenses at the end of one

Q140: The 12-month period that ends when a

Q156: A fiscal year refers to an organization's

Q160: The time period assumption assumes that an

Q172: An_ is a listing of all

Q187: Two accounting principles that are relied on

Q195: If a company reporting on a calendar