Not Answered

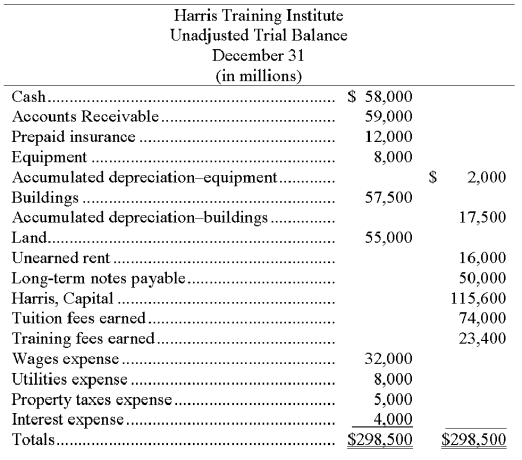

The unadjusted trial balance and the adjustment data for Harris Training Institute are given below along with adjusting entry information. If these adjustments are not recorded, what is the impact on net income? Show calculation for net income without the adjustments and net income with the adjustments. Which one gives the most accurate net income? What accounting principles are being violated if the adjustments are not made?  Additional information items:

Additional information items:

a. The Prepaid Insurance account consists of a payment for a 1 year policy. An analysis of the insurance invoice indicates that one half of the policy has expired by the end of the December 31 year-end.

b. A cash payment for space sublet for 8 months was received on July 1 and was credited to Unearned Rent.

c. Accrued interest expense on the note payable of $1,000 has been incurred but not paid.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Under the alternative method for accounting for

Q11: Using the information given below, prepare a

Q64: If a company mistakenly forgot to record

Q115: The broad principle that requires expenses to

Q138: The accrual basis of accounting:<br>A) Is generally

Q169: On March 31, Phoenix, Inc. paid Melanie

Q181: A company made no adjusting entry for

Q197: An adjusting entry could be made for

Q199: Adjusting is a three-step process (1) _,

Q206: Depreciation expense for a period is the