Not Answered

After preparing an (unadjusted) trial balance at year-end,

G. Chu of Chu Design Company discovered the following errors:

1. Cash payment of the $225 telephone bill for December was recorded twice.

2. Cash payment of a note payable was recorded as a debit to Cash and a debit to Notes Payable for $1,000.

3. A $900 cash withdrawal by the owner was recorded to the correct accounts as $90.

4. An additional investment of $5,000 cash by the owner was recorded as a debit to

G. Chu, Capital and a credit to Cash.

5. A credit purchase of office equipment for $1,800 was recorded as a debit to the Office Equipment account with no offsetting credit entry.

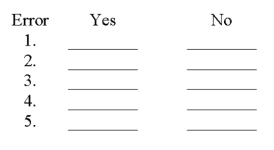

Using the form below, indicate whether the error would cause the trial balance to be out of balance by placing an X in either the yes or no column.

Would the error cause the trial balance to be out of balance?

Would the error cause the trial balance to be out of balance?

Would the error cause the trial balance to be out of balance?

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Transactions are first recorded in the ledger.

Q14: An account used to record the owner's

Q16: Which of the following statements is correct?<br>A)

Q34: Double-entry accounting is an accounting system:<br>A) That

Q36: The chart of accounts is a list

Q48: A transaction that increases an asset and

Q77: All of the following are asset accounts

Q97: Stride Along has total assets of $425

Q123: A _ is a list of all

Q167: Hal Smith opened Smith's Repairs on March