Not Answered

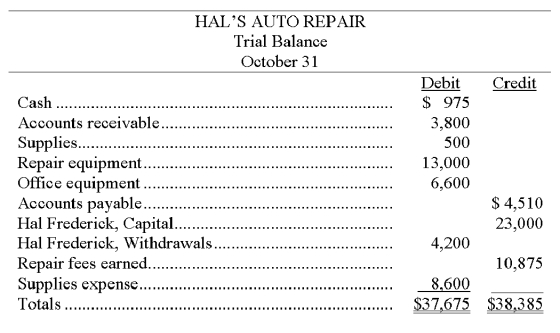

The following trial balance is prepared from the general ledger of Hal's Auto Repair.  Because the trial balance did not balance, you decided to examine the accounting records. You found that the following errors had been made:

Because the trial balance did not balance, you decided to examine the accounting records. You found that the following errors had been made:

1. A purchase of supplies on account for $245 was posted as a debit to Supplies and as a debit to Accounts Payable.

2. An investment of $500 cash by the owner was debited to Hal Frederick, Capital and credited to Cash.

3. In computing the balance of the Accounts Receivable account, a debit of $600 was omitted from the computation.

4. One debit of $300 to the Hal Frederick, Withdrawals account was posted as a credit.

5. Office equipment purchased for $800 was posted to the Repair Equipment account.

6. One entire entry was not posted to the general ledger. The transaction involved the receipt of $125 cash for repair services performed for cash.

Prepare a corrected trial balance for the Hal's Auto Repair as of October 31.

Correct Answer:

Verified

Correct Answer:

Verified

Q17: Cash withdrawn by the owner of a

Q18: The balance sheet reports the financial position

Q56: _ is the process of transferring journal

Q87: Source documents provide evidence of business transactions

Q113: Montgomery Marketing Co. had assets of $475,000;

Q158: An account balance is:<br>A) The total of

Q166: For each of the following errors, indicate

Q170: For each of the following (1) identify

Q180: Rocky Industries received its telephone bill in

Q191: If the Debit and Credit column totals