Multiple Choice

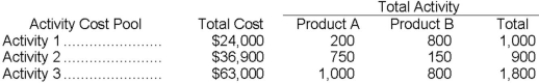

Lindsey Company uses activity-based costing. The company has two products: A and B. The annual production and sales of Product A is 5,000 units and of Product B is 2,000 units. There are three activity cost pools, with total cost and activity as follows:  The activity-based costing cost per unit of Product A is closest to:

The activity-based costing cost per unit of Product A is closest to:

A) $14.11

B) $13.77

C) $7.00

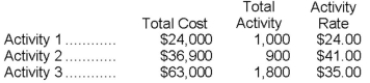

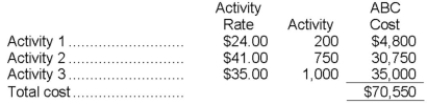

D) $17.70 The activity rates for each activity cost pool are computed as follows: The overhead cost charged to Product A is:

The overhead cost charged to Product A is: Cost per unit = $70,550 ÷ 5,000 units = $14.11 per unit

Cost per unit = $70,550 ÷ 5,000 units = $14.11 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q42: The activity rate under the activity-based costing

Q43: How much indirect factory wages and factory

Q44: Malan Corporation has provided the following data

Q45: When a company shifts from a traditional

Q46: How much cost, in total, would be

Q48: The activity rate for the Processing activity

Q49: Schulenburg Corporation has provided the following data

Q50: Grammer Corporation uses an activity-based costing system

Q51: The activity rate for Activity 2 is

Q52: The activity rate for the Processing activity