Essay

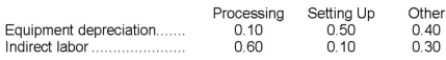

Loader Corporation has an activity-based costing system with three activity cost pools-Processing, Setting Up, and Other. The company's overhead costs consist of equipment depreciation and indirect labor and are allocated to the cost pools in proportion to the activity cost pools' consumption of resources. Equipment depreciation totals $88,000 and indirect labor totals $1,000. Data concerning the distribution of resource consumption across activity cost pools appear below:  Required:

Required:

Assign overhead costs to activity cost pools using activity-based costing.

Correct Answer:

Verified

Assign overhead costs to activity cost p...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q55: Deraney Corporation has an activity-based costing system

Q56: What is the overhead cost assigned to

Q57: Activity-based costing uses a number of activity

Q58: The activity rate for the Supervising activity

Q59: In traditional costing, some manufacturing costs may

Q61: Hettich Corporation uses an activity-based costing system

Q62: Which of the following would probably be

Q63: If the materials handling cost is allocated

Q64: Assuming that the company charges $485.85 for

Q65: In activity-based costing, some manufacturing costs can