Essay

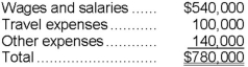

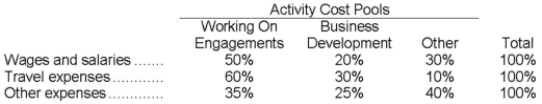

Fife & Jones PLC, a consulting firm, uses an activity-based costing in which there are three activity cost pools. The company has provided the following data concerning its costs and its activity based costing system:

Costs:  Distribution of resource consumption:

Distribution of resource consumption:  Required:

Required:

a. How much cost, in total, would be allocated to the Working On Engagements activity cost pool?

b. How much cost, in total, would be allocated to the Business Development activity cost pool?

c. How much cost, in total, would be allocated to the Other activity cost pool?

Correct Answer:

Verified

All three parts can be answered using a ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: Somani Corporation has an activity-based costing system

Q83: The costs of activities that are classified

Q84: How much overhead cost is allocated to

Q85: How much overhead cost is allocated to

Q86: Which of the following costs should not

Q88: Foradori Corporation's activity-based costing system has three

Q89: Assuming that all of the costs listed

Q90: Assembling a product is an example of

Q91: Lovette Corporation has an activity-based costing system

Q92: What is the product margin for Product