Essay

Benoist Corporation has an activity-based costing system with three activity cost pools-Machining, Setting Up, and Other. The company's overhead costs have already been allocated to the cost pools and total $17,200 for the Machining cost pool, $7,700 for the Setting Up cost pool, and $52,100 for the Other cost pool.

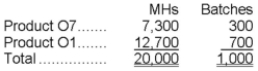

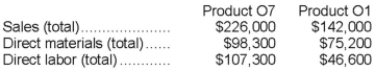

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs appear below:

Required:

Required:

a. Calculate activity rates for each activity cost pool using activity-based costing.

b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

c. Determine the product margins for each product using activity-based costing.

Correct Answer:

Verified

a. Computation of activity rat...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q115: Radakovich Corporation has provided the following data

Q116: How much overhead cost is allocated to

Q117: Duerr Corporation uses an activity-based costing system

Q118: The activity rate for the Order Filling

Q119: The activity rate for the Supervising activity

Q121: Organization-sustaining overhead costs should be allocated to

Q122: Garhart Corporation uses the following activity rates

Q123: Ginger Corporation uses an activity-based costing system

Q124: Assuming that all of the costs listed

Q125: What is the product margin for Product