Essay

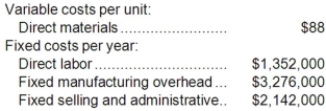

Ellert Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative costs. During its first year of operations, the company produced 52,000 units and sold 51,000 units. The company's only product is sold for $251 per unit.

The company does not have any variable manufacturing overhead costs or variable selling and administrative costs. During its first year of operations, the company produced 52,000 units and sold 51,000 units. The company's only product is sold for $251 per unit.

Required:

a. Assume the company uses super-variable costing. Compute the unit product cost for the year and prepare an income statement for the year.

b. Assume that the company uses a variable costing system that assigns $26 of direct labor cost to each unit that is produced. Compute the unit product cost for the year and prepare an income statement for the year.

Correct Answer:

Verified

a. Under super-variable costin...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q29: The company is considering using either super-variable

Q30: Wahler Corporation manufactures and sells one product.

Q31: Assume that the company uses an absorption

Q32: Assume that the company uses an absorption

Q33: The unit product cost under super-variable costing

Q35: Assume that the company uses an absorption

Q36: The company is considering using either super-variable

Q37: Grand Corporation manufactures and sells one product.

Q38: Super-variable costing is a costing method that

Q39: All differences between super-variable costing and absorption