Multiple Choice

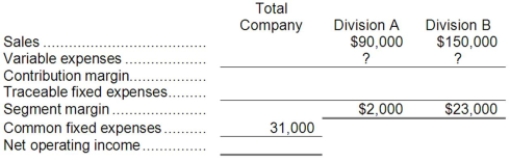

Denner Corporation has two divisions, A and B. The following data pertain to operations in October:  If common fixed expenses were $31,000, total fixed expenses were:

If common fixed expenses were $31,000, total fixed expenses were:

A) $31,000

B) $62,000

C) $93,000

D) $52,000 Division A:

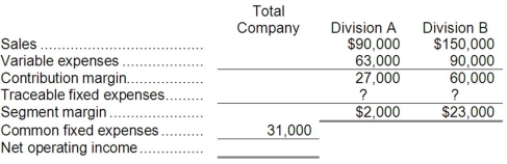

Division A:

Variable expenses = Variable expense ratio × Sales

= 0) 70 × $90,000 = $63,000

Division B:

Variable expenses = Variable expense ratio × Sales

= 0) 60 × $150,000 = $90,000 Division A:

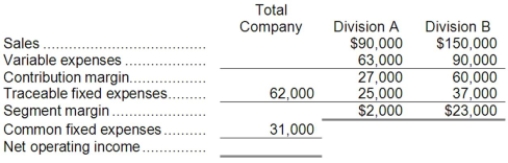

Division A:

Segment margin = Contribution margin - Traceable fixed expenses

$2,000 = $27,000 - Traceable fixed expenses

Traceable fixed expenses = $27,000 - $2,000 = $25,000

Division B:

Segment margin = Contribution margin - Traceable fixed expenses

$23,000 = $60,000 - Traceable fixed expenses

Traceable fixed expenses = $60,000 - $23,000 = $37,000 Total fixed expenses = Traceable fixed expenses + Common fixed expenses

Total fixed expenses = Traceable fixed expenses + Common fixed expenses

= $62,000 + $31,000 = $93,000

Correct Answer:

Verified

Correct Answer:

Verified

Q118: What is the net operating income for

Q119: Warburton Corporation has two divisions: Alpha and

Q120: Data for March concerning Mauger Corporation's two

Q121: The total contribution margin for the month

Q122: Corporation Z has two divisions: A &

Q124: When viewed over the long term, cumulative

Q125: The unit product cost under absorption costing

Q126: Mitchel Corporation manufactures a single product. Last

Q127: If the Northern Division's sales last year

Q128: Under variable costing, fixed manufacturing overhead is:<br>A)carried