Essay

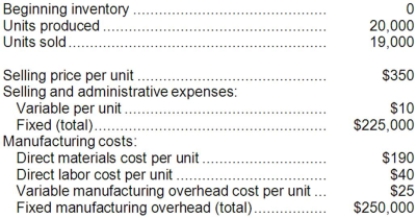

The Dean Corporation produces and sells a single product. The following data refer to the year just completed:  Assume that direct labor is a variable cost.

Assume that direct labor is a variable cost.

Required:

a. Compute the cost of a single unit of product under both the absorption costing and variable costing approaches.

b. Prepare an income statement for the year using absorption costing.

c. Prepare a contribution format income statement for the year using variable costing.

d. Reconcile the absorption costing and variable costing net operating income figures in (b) and (c) above.

Correct Answer:

Verified

a. Cost per unit under absorption costin...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q193: A properly constructed segmented income statement in

Q194: What is the net operating income for

Q195: Under absorption costing, the cost of goods

Q196: Craft Corporation produces a single product. Last

Q197: Under variable costing, the company's net operating

Q199: A manufacturing company that produces a single

Q200: What is the total period cost for

Q201: Crow Corporation produces a single product and

Q202: Net operating income under variable costing for

Q203: For the year in question, one would