Multiple Choice

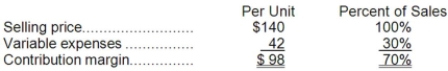

Hartung Corporation produces and sells a single product. Data concerning that product appear below:  Fixed expenses are $147,000 per month. The company is currently selling 2,000 units per month. The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $13 per unit. In exchange, the sales staff would accept a decrease in their salaries of $22,000 per month. (This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 400 units. What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $147,000 per month. The company is currently selling 2,000 units per month. The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $13 per unit. In exchange, the sales staff would accept a decrease in their salaries of $22,000 per month. (This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 400 units. What should be the overall effect on the company's monthly net operating income of this change?

A) increase of $16,800

B) increase of $226,000

C) increase of $30,000

D) decrease of $14,000

Correct Answer:

Verified

Correct Answer:

Verified

Q84: This question is to be considered independently

Q86: Data concerning Bunck Corporation's single product appear

Q87: One way to compute the total contribution

Q88: Hargenrader Inc. produces and sells two products.

Q90: All other things the same, if the

Q91: If a company decreases the variable expense

Q92: All other things the same, a reduction

Q93: Marano Corporation produces and sells a single

Q94: Seiersen Corporation's contribution format income statement for

Q318: For a capital intensive, automated company the