Multiple Choice

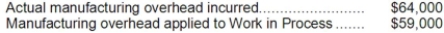

Smallwood Corporation has provided the following data concerning manufacturing overhead for January:  The Corporation's Cost of Goods Sold was $223,000 prior to closing out its Manufacturing Overhead account. The Corporation closes out its Manufacturing Overhead account to Cost of Goods Sold. Which of the following statements is true?

The Corporation's Cost of Goods Sold was $223,000 prior to closing out its Manufacturing Overhead account. The Corporation closes out its Manufacturing Overhead account to Cost of Goods Sold. Which of the following statements is true?

A) Manufacturing overhead for the month was overapplied by $5,000; Cost of Goods Sold after closing out the Manufacturing Overhead account is $228,000

B) Manufacturing overhead for the month was underapplied by $5,000; Cost of Goods Sold after closing out the Manufacturing Overhead account is $218,000

C) Manufacturing overhead for the month was underapplied by $5,000; Cost of Goods Sold after closing out the Manufacturing Overhead account is $228,000

D) Manufacturing overhead for the month was overapplied by $5,000; Cost of Goods Sold after closing out the Manufacturing Overhead account is $218,000

Correct Answer:

Verified

Correct Answer:

Verified

Q25: The applied manufacturing overhead for the year

Q26: In a job-order costing system, the use

Q27: Soledad Corporation had $36,000 of raw materials

Q28: The journal entry to record the allocation

Q29: Weldin Inc. has provided the following data

Q31: Job cost sheets are used to record

Q32: The cost of goods manufactured for July

Q33: During February at Iniquez Corporation, $79,000 of

Q34: Stelmack Corporation, a manufacturing Corporation, has provided

Q35: A proper journal entry to record issuing