Essay

The Commonwealth Company uses a job-order costing system and applies manufacturing overhead cost to jobs using a predetermined overhead rate based on the cost of materials used in production. At the beginning of the year, the following estimates were made as a basis for computing the predetermined overhead rate: manufacturing overhead cost, $186,000; direct materials cost, $155,000. The following transactions took place during the year (all purchases and services were acquired on account):

a. Raw materials purchased, $96,000.

b. Raw materials requisitioned for use in production (all direct materials), $88,000.

c. Utility bills incurred in the factory, $17,000.

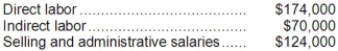

d. Costs for salaries and wages incurred as follows:  e. Maintenance costs incurred in the factory, $12,000.

e. Maintenance costs incurred in the factory, $12,000.

f. Advertising costs incurred, $98,000.

g. Depreciation recorded for the year, $75,000 (75 percent relates to factory assets and the remainder relates to selling, general, and administrative assets).

h. Rental cost incurred on buildings, $80,000 (80 percent of the space is occupied by the factory, and 20 percent is occupied by sales and administration).

i. Miscellaneous selling, general, and administrative costs incurred, $12,000.

j. Manufacturing overhead cost was applied to jobs.

k. Cost of goods manufactured for the year, $480,000.

l. Sales for the year (all on account) totaled $900,000. These goods cost $550,000 to manufacture.

Required:

Prepare journal entries to record the information above. Key your entries by the letters a through l.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: The overhead for the year was:<br>A)$702 underapplied<br>B)$898

Q20: Christofferse Corporation bases its predetermined overhead rate

Q21: During October, Dorinirl Corporation incurred $60,000 of

Q22: Which of the following entries or sets

Q23: Buker Corporation bases its predetermined overhead rate

Q25: The applied manufacturing overhead for the year

Q26: In a job-order costing system, the use

Q27: Soledad Corporation had $36,000 of raw materials

Q28: The journal entry to record the allocation

Q29: Weldin Inc. has provided the following data