Multiple Choice

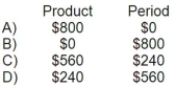

A manufacturing company prepays its insurance coverage for a three-year period. The premium for the three years is $2,400 and is paid at the beginning of the first year. Seventy percent of the premium applies to manufacturing operations and thirty percent applies to selling and administrative activities. What amounts should be considered product and period costs respectively for the first year of coverage?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q40: The _ is the amount remaining from

Q41: The conversion cost for September was:<br>A)$114,000<br>B)$131,000<br>C)$171,000<br>D)$103,000

Q42: Which of the following would most likely

Q43: A sunk cost is:<br>A)a cost which may

Q44: The following data pertains to activity and

Q46: The total of the manufacturing overhead costs

Q47: The prime cost for September was:<br>A)$114,000<br>B)$100,000<br>C)$103,000<br>D)$47,000

Q48: The costs of the Accounting Department at

Q49: Harris Corporation is a wholesaler that sells

Q50: Variable costs are costs that vary, in