Multiple Choice

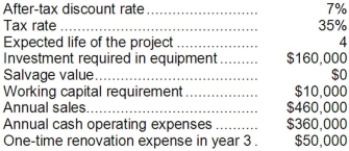

Blier Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. The income tax expense in year 2 is:

The company uses straight-line depreciation on all equipment. The income tax expense in year 2 is:

A) $17,500

B) $3,500

C) $35,000

D) $21,000

Correct Answer:

Verified

Correct Answer:

Verified

Q126: Dekle Corporation has provided the following information

Q127: A company anticipates incremental net income (i.e.,

Q128: Foucault Corporation has provided the following information

Q129: Gouker Corporation has provided the following information

Q130: Starrs Corporation has provided the following information

Q132: Corchado Corporation is considering a capital budgeting

Q133: The following information concerning a proposed capital

Q134: Skolfield Corporation is considering a capital budgeting

Q135: Dekle Corporation has provided the following information

Q136: Unless the organization is tax-exempt, income taxes