Multiple Choice

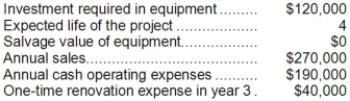

Lasater Corporation has provided the following information concerning a capital budgeting project:  The company's tax rate is 35%. The company's after-tax discount rate is 15%. The project would require an investment of $10,000 at the beginning of the project. This working capital would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 2 is:

The company's tax rate is 35%. The company's after-tax discount rate is 15%. The project would require an investment of $10,000 at the beginning of the project. This working capital would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 2 is:

A) $62,500

B) $36,500

C) $50,000

D) $80,000

Correct Answer:

Verified

Correct Answer:

Verified

Q119: Trammel Corporation is considering a capital budgeting

Q120: Stack Corporation is considering a capital budgeting

Q121: Trammel Corporation is considering a capital budgeting

Q122: El Corporation has provided the following information

Q123: Hothan Corporation has provided the following information

Q125: Glasco Corporation has provided the following information

Q126: Dekle Corporation has provided the following information

Q127: A company anticipates incremental net income (i.e.,

Q128: Foucault Corporation has provided the following information

Q129: Gouker Corporation has provided the following information