Multiple Choice

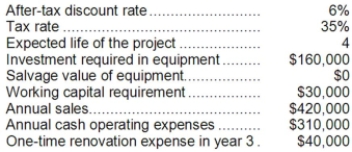

Lucarell Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. The income tax expense in year 3 is:

The company uses straight-line depreciation on all equipment. The income tax expense in year 3 is:

A) $24,500

B) $14,000

C) $10,500

D) $38,500

Correct Answer:

Verified

Correct Answer:

Verified

Q112: A company needs an increase in working

Q113: Brogden Corporation has provided the following information

Q114: Bourret Corporation has provided the following information

Q115: Foucault Corporation has provided the following information

Q116: Holzner Corporation has provided the following information

Q118: Pont Corporation has provided the following information

Q119: Trammel Corporation is considering a capital budgeting

Q120: Stack Corporation is considering a capital budgeting

Q121: Trammel Corporation is considering a capital budgeting

Q122: El Corporation has provided the following information