Multiple Choice

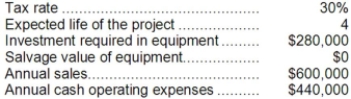

Onorato Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 2 is:

The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 2 is:

A) $133,000

B) $160,000

C) $90,000

D) $98,000

Correct Answer:

Verified

Correct Answer:

Verified

Q20: Battaglia Corporation is considering a capital budgeting

Q21: Welti Corporation has provided the following information

Q22: Folino Corporation is considering a capital budgeting

Q23: Soffer Corporation has provided the following information

Q24: Glasco Corporation has provided the following information

Q26: Stortz Corporation is considering a capital budgeting

Q27: Mota Corporation has provided the following information

Q28: Voelkel Corporation has provided the following information

Q29: Darnold Corporation has provided the following information

Q30: Foucault Corporation has provided the following information