Multiple Choice

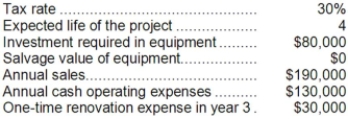

Wollard Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. The income tax expense in year 3 is:

The company uses straight-line depreciation on all equipment. The income tax expense in year 3 is:

A) $3,000

B) $12,000

C) $18,000

D) $9,000

Correct Answer:

Verified

Correct Answer:

Verified

Q51: Pilarz Corporation has provided the following information

Q52: Lanfranco Corporation is considering a capital budgeting

Q53: Starrs Corporation has provided the following information

Q54: Bosell Corporation has provided the following information

Q55: Battaglia Corporation is considering a capital budgeting

Q57: Milliner Corporation has provided the following information

Q58: Boch Corporation has provided the following information

Q59: Leamon Corporation is considering a capital budgeting

Q60: Croes Corporation has provided the following information

Q61: Ferriman Corporation is considering a capital budgeting