Multiple Choice

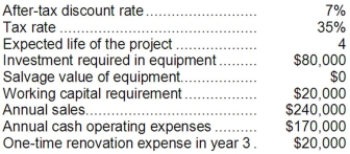

Pulkkinen Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 2 is:

The company uses straight-line depreciation on all equipment. The total cash flow net of income taxes in year 2 is:

A) $70,000

B) $50,000

C) $52,500

D) $39,500

Correct Answer:

Verified

Correct Answer:

Verified

Q74: (Appendix 13C) Prudencio Corporation has provided the

Q106: Trammel Corporation is considering a capital budgeting

Q107: Boch Corporation has provided the following information

Q108: Mitton Corporation is considering a capital budgeting

Q109: Skolfield Corporation is considering a capital budgeting

Q112: A company needs an increase in working

Q113: Brogden Corporation has provided the following information

Q114: Bourret Corporation has provided the following information

Q115: Foucault Corporation has provided the following information

Q116: Holzner Corporation has provided the following information