Multiple Choice

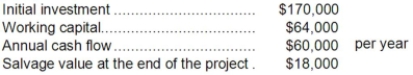

Dul Corporation has provided the following data concerning an investment project that it is considering:  The working capital would be released for use elsewhere at the end of the project in 3 years. The company's discount rate is 7%. The net present value of the project is closest to:

The working capital would be released for use elsewhere at the end of the project in 3 years. The company's discount rate is 7%. The net present value of the project is closest to:

A) $(61,872)

B) $(9,648)

C) $10,000

D) $54,352

Correct Answer:

Verified

Correct Answer:

Verified

Q78: (Ignore income taxes in this problem.) Mark

Q79: (Ignore income taxes in this problem.) Mercer

Q80: (Ignore income taxes in this problem) The

Q81: (Ignore income taxes in this problem.) Shiffler

Q82: (Ignore income taxes in this problem.) The

Q84: (Ignore income taxes in this problem.) Baker

Q85: Czlapinski Corporation is considering a capital budgeting

Q86: For capital budgeting decisions, the simple rate

Q87: (Ignore income taxes in this problem.) The

Q88: The net present value of a proposed