Essay

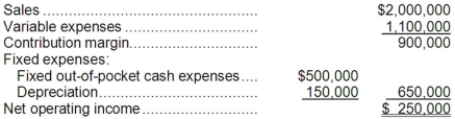

(Ignore income taxes in this problem.) Tranter, Inc., is considering a project that would have a ten-year life and would require a $1,500,000 investment in equipment. At the end of ten years, the project would terminate and the equipment would have no salvage value. The project would provide net operating income each year as follows:  All of the above items, except for depreciation, represent cash flows. The company's required rate of return is 12%.

All of the above items, except for depreciation, represent cash flows. The company's required rate of return is 12%.

Required:

a. Compute the project's net present value.

b. Compute the project's internal rate of return to the nearest whole percent.

c. Compute the project's payback period.

d. Compute the project's simple rate of return.

Correct Answer:

Verified

a. Because depreciation is the only nonc...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q66: (Ignore income taxes in this problem.) Swaggerty

Q67: (Ignore income taxes in this problem.) Buy-Rite

Q68: (Ignore income taxes in this problem.) Jason

Q69: (Ignore income taxes in this problem.) Carlson

Q70: (Ignore income taxes in this problem.) Bonamo

Q72: (Ignore income taxes in this problem.) Veys

Q73: If the internal rate of return exceeds

Q74: (Ignore income taxes in this problem.) Overland

Q75: (Ignore income taxes in this problem.) Cascade,

Q76: (Ignore income taxes in this problem.) Baldock