Multiple Choice

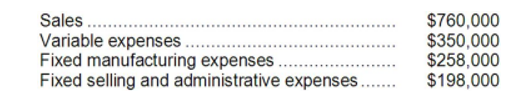

The management of Cackowski Corporation has been concerned for some time with the financial performance of its product I11S and has considered discontinuing it on several occasions. Data from the company's accounting system appear below:

In the company's accounting system all fixed expenses of the company are fully allocated to products. Further investigation has revealed that $185,000 of the fixed manufacturing expenses and $132,000 of the fixed selling and administrative expenses are avoidable if product I11S is discontinued.

-What would be the effect on the company's overall net operating income if product I11S were dropped?

A) Overall net operating income would decrease by $46,000.

B) Overall net operating income would increase by $93,000.

C) Overall net operating income would increase by $46,000.

D) Overall net operating income would decrease by $93,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q34: The management of Leinberger Corporation is considering

Q35: Zemlya Corporation currently records $4,000 of depreciation

Q36: Dowchow Corporation makes two products from a

Q37: Consider the following production and cost data

Q38: The most recent monthly income statement for

Q40: Eliminating nonproductive processing time is particularly important

Q41: In a decision to drop a product,

Q42: Hadley, Inc. makes a line of bathroom

Q43: Only future costs that differ between alternatives

Q44: Management is considering a one-time-only special order.