Multiple Choice

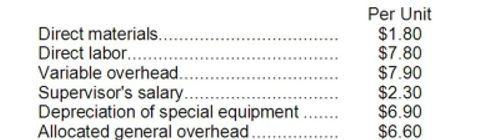

Rama Corporation is presently making part J56 that is used in one of its products. A total of 4,000 units of this part are produced and used every year. The company's Accounting Department reports the following costs of producing the part at this level of activity:

An outside supplier has offered to produce and sell the part to the company for $30.80 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally.

-If management decides to buy part J56 from the outside supplier rather than to continue making the part, what would be the annual impact on the company's overall net operating income?

A) Net operating income would increase by $44,000 per year.

B) Net operating income would increase by $10,000 per year.

C) Net operating income would decline by $10,000 per year.

D) Net operating income would decline by $44,000 per year.

Correct Answer:

Verified

Correct Answer:

Verified

Q136: Mitchener Corp. manufactures three products from a

Q137: Two products, LB and NH, emerge from

Q138: Fahringer Corporation makes three products that use

Q139: Zuppa Corporation currently maintains its own printing

Q140: The Molis Corporation has the capacity to

Q142: The Milham Corporation has two divisions-East and

Q143: Jebb's Lettuce Stand currently sells 60,000 heads

Q144: The constraint at Johngrass Corporation is time

Q145: Mankus Inc. is considering using stocks of

Q146: One way to increase the effective utilization