Multiple Choice

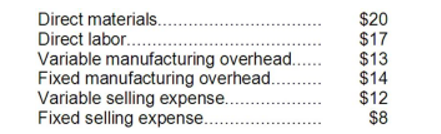

The Melrose Corporation produces a single product, Product C. Melrose has the capacity to produce 70,000 units of Product C each year. If Melrose produces at capacity, the per unit costs to produce and sell one unit of Product C are as follows:

The regular selling price of one unit of Product C is $100. A special order has been received by Melrose from Moore Corporation to purchase 7,000 units of Product C during the upcoming year. If this special order is accepted, the variable selling expense will be reduced by 75%. Total fixed manufacturing overhead and fixed selling expenses would be unaffected except that Melrose will need to purchase a specialized machine to engrave the Moore name on each unit of product C in the special order. The machine will cost $10,500 and will have no use after the special order is filled. Assume that direct labor is a variable cost.

-Assume that Melrose expects to sell 60,000 units of Product C to regular customers next year. At what selling price for the 7,000 units would Melrose be economically indifferent between accepting and rejecting the special order from Moore?

A) $53.00

B) $54.50

C) $75.00

D) $76.50

Correct Answer:

Verified

Correct Answer:

Verified

Q61: Wright, Inc. produces three products. Data concerning

Q62: Adamyan Co. manufactures and sells medals for

Q63: An avoidable cost is a cost that

Q64: Lusk Corporation produces and sells 20,000 units

Q65: A cost that can be avoided by

Q67: Dockwiller Inc. manufactures industrial components. One of

Q68: The Madison Corporation produces three products with

Q69: Benjamin Signal Company produces products R, J,

Q70: Gwinnett Barbecue Sauce Corporation manufactures a specialty

Q71: Juett Company produces a single product. The