Multiple Choice

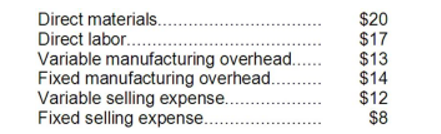

The Melrose Corporation produces a single product, Product C. Melrose has the capacity to produce 70,000 units of Product C each year. If Melrose produces at capacity, the per unit costs to produce and sell one unit of Product C are as follows:

The regular selling price of one unit of Product C is $100. A special order has been received by Melrose from Moore Corporation to purchase 7,000 units of Product C during the upcoming year. If this special order is accepted, the variable selling expense will be reduced by 75%. Total fixed manufacturing overhead and fixed selling expenses would be unaffected except that Melrose will need to purchase a specialized machine to engrave the Moore name on each unit of product C in the special order. The machine will cost $10,500 and will have no use after the special order is filled. Assume that direct labor is a variable cost.

-Suppose Melrose can sell 68,000 units of Product C to regular customers next year. If Moore Corporation offers to buy the special order units at $90 per unit, the effect of accepting the special order for 7,000 units on Melrose's net operating income for next year will be a:

A) $79,500 increase

B) $104,000 increase

C) $114,500 increase

D) $294,000 increase

Correct Answer:

Verified

Correct Answer:

Verified

Q145: Mankus Inc. is considering using stocks of

Q146: One way to increase the effective utilization

Q147: Kampmann Corporation is presently making part Z95

Q148: A customer has requested that Gamba Corporation

Q149: Bulan Inc. makes a range of products.

Q151: Dowchow Corporation makes two products from a

Q152: Consider the following statements: I. A division's

Q153: In a special order situation, any fixed

Q154: Duarte Corporation processes sugar beets that it

Q155: Roddey Corporation is a specialty component manufacturer