Essay

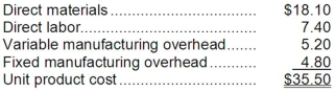

Tullius Corporation has received a request for a special order of 8,000 units of product C64 for $50.00 each. The normal selling price of this product is $53.25 each, but the units would need to be modified slightly for the customer. The normal unit product cost of product C64 is computed as follows:  Direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like some modifications made to product C64 that would increase the variable costs by $5.00 per unit and that would require a one-time investment of $43,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order.

Direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like some modifications made to product C64 that would increase the variable costs by $5.00 per unit and that would require a one-time investment of $43,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order.

Required:

Determine the effect on the company's total net operating income of accepting the special order. Show your work!

Correct Answer:

Verified

Correct Answer:

Verified

Q5: In a factory operating at capacity, not

Q6: Manico Corporation produces three products -- X,

Q7: Wehn Refiners, Inc., processes sugar cane that

Q8: Farnsworth Television makes and sells portable television

Q9: A cost that is relevant in one

Q11: Foster Company makes 20,000 units per year

Q12: Brown Corporation makes four products in a

Q13: An outside supplier has offered to sell

Q14: The following are the Jensen Corporation's unit

Q15: The Melrose Corporation produces a single product,