Multiple Choice

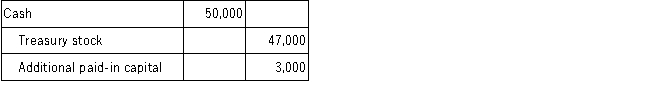

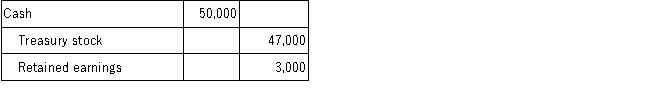

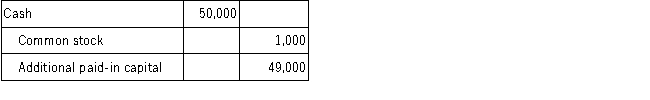

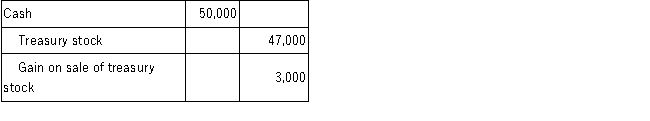

On February 1, 2015, Cue Company acquired 1,000 shares of its $1 par value stock for $47 per share and held these shares in treasury. On April 10, 2016, Cue resold all the treasury shares for $50 per share. Which of the following entries would be recorded when Cue Company resells the shares of treasury stock?

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q35: Preferred stockholders do not have voting rights

Q46: The dividend yield ratio increases when a

Q78: Date on which the dividend checks are

Q79: For the listed items below, identify the

Q82: Wendell Company provided the following pertaining to

Q86: Earnings per share is calculated by dividing

Q87: Which of the following statements is false?<br>A)Both

Q87: The charter of Delta Corporation specified a

Q88: The following information is provided for Bold

Q107: Common stockholders have voting rights and can