Multiple Choice

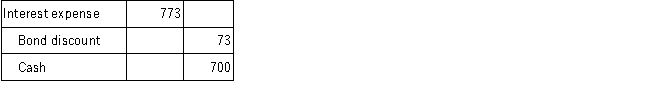

On January 1, 2016, Tonika Company issued a four-year, $10,000, 7% bond. The interest is payable annually each December 31. The issue price was $9,668 based on an 8% effective interest rate. Tonika uses the effective-interest amortization method. Rounding calculations to the nearest whole dollar, which of the following journal entries correctly records the 2016 interest expense?

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q36: Which of the following statements is correct?<br>A)An

Q58: Which of the following statements incorrectly describes

Q77: A company prepared the following journal entry:

Q80: On January 1, 2016, a company issued

Q81: Zero coupon bonds are bonds that are

Q84: The issuing company and the bond underwriter

Q86: The following information was taken from the

Q87: On January 1, 2016, Jason Company issued

Q97: Interest expense decreases over time when a

Q125: Assuming no adjusting journal entries have been