Essay

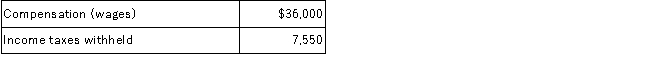

The following data were provided by the detailed payroll records of Mountain Corporation for the last week of March 2017, which will not be paid until April 5, 2017:  FICA taxes at a 7.65% rate (no employee had reached the maximum).

FICA taxes at a 7.65% rate (no employee had reached the maximum).

Required:

A.Prepare the March 31, 2017 journal entry to record the payroll and the related employee deductions.

B.Prepare the March 31, 2017 journal entry to record the employer's FICA payroll tax expense.

C.Calculate the total payroll-related liabilities at March 31, 2017 using the results of requirements (A) and (B).

Correct Answer:

Verified

C. Total payroll-related liabilities M...

C. Total payroll-related liabilities M...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q26: An annuity is a series of consecutive

Q40: Commander Appliance Store prepares annual financial statements

Q41: Miranda Company borrowed $100,000 cash on September

Q42: The following data is available for Tommy's

Q43: Mission Corp. borrowed $50,000 cash on April

Q45: Rachel Corporation purchased a building by paying

Q48: Which of the following statements is correct?<br>A)Current

Q49: Which of the following questions is incorrect

Q65: Accounts payable and accrued liabilities are interchangeable

Q110: Working capital increases when a company accrues