Essay

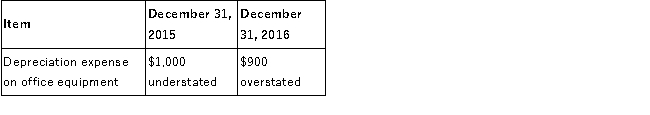

The financial statements of Franklin Company contained the following errors:  Required:

Required:

A.Was net income for 2015 understated or overstated? Briefly explain your answer.

B.1.Considering the effect of the errors of both years at December 31, 2016, is retained earnings overstated or understated, and by what amount?

2.Briefly explain your answer to part B (1).

Correct Answer:

Verified

A. Overstated. If depreciation expense i...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: During 2016, a company purchased a mine

Q3: Which of the following includes only intangible

Q5: Covey Company purchased a machine on January

Q11: During 2016, a company purchased a mine

Q40: Ordinary repairs and maintenance costs are incurred

Q43: Use of the double-declining-balance method of depreciation

Q80: If a company has an asset with

Q90: Goodwill is recorded only when an existing

Q107: The units-of-production method of depreciation allocates an

Q112: Depreciation is the process of estimating a