Essay

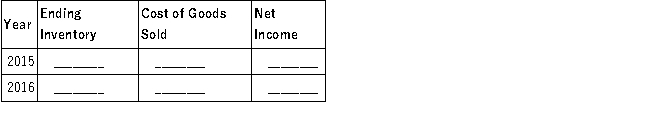

Redford Company hired a new store manager in October 2015, who determined the ending inventory on December 31, 2015, to be $50,000. In March, 2016, the company discovered that the December 31, 2015 ending inventory should have been $58,000. The December 31, 2016, inventory was correct. Ignore income taxes.

Required:

Complete the following table to show the effects of the inventory error on the four amounts listed. Give the amount of the discrepancy and indicate whether it was overstated (O), understated (U), or had no effect (N).

Correct Answer:

Verified

Correct Answer:

Verified

Q9: An increase in inventory is subtracted from

Q19: Inventory turnover is calculated as cost of

Q36: The records of Atlantis Company reflected the

Q37: Which of the following statements is incorrect?<br>A)A

Q38: Quest Inc. provided the following disclosure note

Q39: Jennings Company uses the periodic inventory system

Q42: QV-TV, Inc. provided the following items in

Q43: On December 15, 2016, Transport Company accepted

Q44: Coulter Company uses the LIFO inventory method

Q45: Manufactured goods transferred out of work in