Multiple Choice

Woodland Company uses the allowance method to account for bad debts. During 2016, a customer declared bankruptcy and a receivable of $10,000 was deemed uncollectible. Which of the following journal entries records Woodland's uncollectible account write-off?

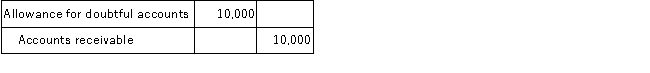

A)

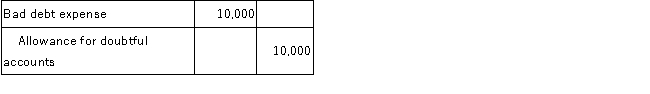

B)

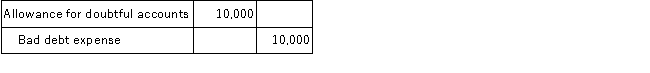

C)

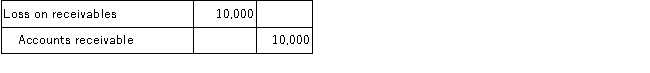

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q38: Which of the following correctly describes the

Q85: When a credit sale is made with

Q87: When preparing the statement of cash flows,the

Q91: The Soft Company has provided the following

Q118: The year-end journal entry to record bad

Q119: When a particular account receivable is determined

Q120: Which of the following journal entries correctly

Q121: One of Hawk Company's customers returned products

Q125: Which of the following does not correctly

Q127: Clark Company estimated the net realizable value