Essay

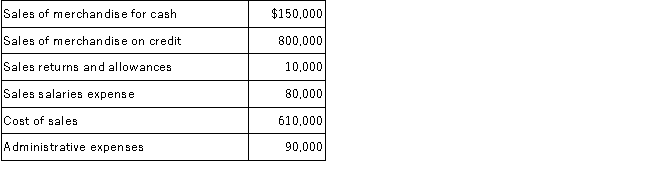

The following data were taken from the records of Lilo Corporation for the year ended December 31, 2016 before any adjustment for bad debt expense:  The following items have not been included in above amounts:

The following items have not been included in above amounts:

Estimated bad debt expense is 1% of credit sales.

The income tax rate is 35%.

10,000 of shares of common stock are outstanding.

Required:

A.Calculate the bad debt expense.

B.Prepare a multiple-step income statement (including gross profit, income before income taxes, and earnings per share).

Correct Answer:

Verified

A. Bad debt expense ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: The CHS Company has provided the following

Q20: Chicago Company has hired you to reconcile

Q25: On June 1, 2016, Concorde Company sold

Q27: A recent annual report for Kirova Company

Q28: Which of the following transactions will result

Q34: At year-end,Chief Company has a balance of

Q58: The journal entry to record bad debt

Q106: Which of the following is correct when

Q131: A deposit in transit in a bank

Q132: The journal entry to write off an