Essay

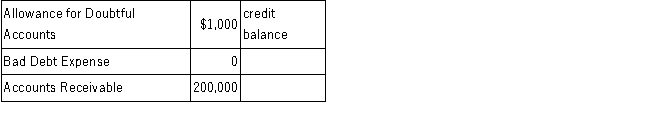

Prior to the year-end adjustment to record bad debt expense for 2016 the general ledger of Stickler Company included the following accounts and balances:  Cash collections on accounts receivable during 2016 amounted to $450,000. Sales revenue during 2016 amounted to $800,000, of which 75% was on credit, and it was estimated that 2% of these credit sales made in 2016 would ultimately become uncollectible.

Cash collections on accounts receivable during 2016 amounted to $450,000. Sales revenue during 2016 amounted to $800,000, of which 75% was on credit, and it was estimated that 2% of these credit sales made in 2016 would ultimately become uncollectible.

Required:

A.Calculate the bad debt expense for 2016.

B.Determine the adjusted 2016 year-end balance of the allowance for doubtful accounts.

C.Determine the net realizable value of accounts receivable for the December 31, 2016 balance sheet.

Correct Answer:

Verified

A. Bad debt expense, $12,000 = [($800,00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: Which of the following is not a

Q31: Cyclone Inc. reported the following figures from

Q33: A portion of the income statement for

Q33: Flyer Company has provided the following information

Q36: Indicate whether each of the accounts listed

Q38: If the accounts receivable turnover ratio increases,

Q78: Determine the effect of the following transactions

Q82: When a depositor receives a bank statement

Q99: Effective internal control of cash should include

Q132: The journal entry to write off an