Essay

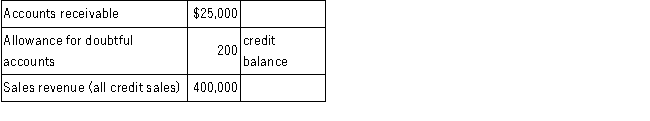

On December 31, 2016, Colonial Corporation had the following account balances related to credit sales and receivables prior to recording adjusting entries:  Required:

Required:

Prepare the necessary year-end adjusting entry related to uncollectible accounts for each of the following independent assumptions:

A.An aging of accounts receivable is completed.It is estimated that $2,150 of the receivables outstanding at year-end will be uncollectible.

B.Assume the same information presented in part A above except that, prior to adjustment, the allowance for doubtful accounts had a debit balance of $200 rather than a credit balance of $200.

C.It is estimated that a provision for bad debts is required for 1% of credit sales for the year.

Correct Answer:

Verified

A.

Bad debt expense

1,950

Allowance for ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Bad debt expense

1,950

Allowance for ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Flyer Company has provided the following information

Q5: What would be incorrect about reporting accounts

Q15: Why is the reconciliation of a company's

Q54: Sabre Company sold inventory costing $600 to

Q68: Sales returns and allowances is a contra-revenue

Q69: Gross profit is calculated as gross sales

Q71: Credit terms of "2/10,n/30" mean that if

Q92: Which of the following does not correctly

Q94: Asia Company sold $10,000 of goods to

Q100: Prior year financial statements are adjusted when