Multiple Choice

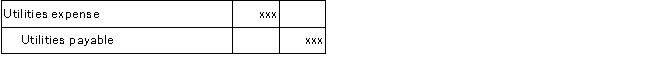

Which of the following correctly describes the following adjusting journal entry?

A) Total assets decrease and net income decreases.

B) Stockholders' equity decreases and liabilities increase.

C) The transaction is an example of a deferral.

D) Net income decreases and stockholders' equity does not change.

Correct Answer:

Verified

Correct Answer:

Verified

Q103: Bridge Company keeps a small inventory of

Q104: A calendar-year reporting company preparing its annual

Q105: On December 1, 2016, Fleet Company paid

Q106: On July 1, 2016, Bass Company paid

Q107: The adjusting entry to record accrued revenues

Q108: Top Company's 2016 sales revenue was $200,000

Q109: Which of the following correctly describes the

Q110: Which of the following journal entries is

Q112: On September 1, 2016, Fast Track, Inc.

Q114: What is the purpose of adjusting entries?