Essay

Four transactions described below were completed during 2016 by Russell Company. The books are adjusted only at year-end.

A.On December 31, 2016, Russell Company owed employees $3,750 for wages that were earned by them during December and were not recorded.

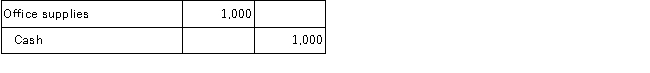

B.During 2016, Russell Company purchased office supplies that cost $1,000, which were placed in the supplies room for use as needed.The purchase was recorded as follows:

At January 1, 2016, the amount of unused office supplies was $300.At December 31, 2016, a physical count showed unused office supplies in the supply room amounting to $100.

At January 1, 2016, the amount of unused office supplies was $300.At December 31, 2016, a physical count showed unused office supplies in the supply room amounting to $100.

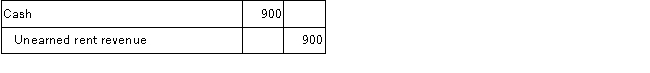

C.On December 1, 2016, Russell Company rented some office space to another party.Russell Company collected $900 rent for the period December 1, 2016, to March 1, 2016.The December 1 transaction was recorded as follows:

D.On July 1, 2016, Russell Company borrowed $12,000 cash on a one-year, 8% interest-bearing, note payable.The interest is payable on the due date of the note, June 30, 2017.The borrowing was recorded as follows on July 1, 2016:

Correct Answer:

Verified

Correct Answer:

Verified

Q14: Cash collected from customers in advance of

Q27: Which of the following best describes the

Q61: Deferred expenses are initially recorded as assets

Q106: The year-end closing process transfers net income

Q118: On December 31, 2016, Krug Company prepared

Q120: Which of the following is not a

Q121: For each of the following accounts you

Q124: On December 31, 2016, The Bates Company's

Q126: Which of the following does not correctly

Q128: Johnson Corporation is completing the accounting information