Multiple Choice

Table 18-5

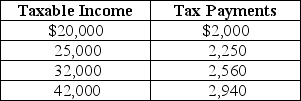

Table 18-5 shows the amount of taxes paid on various levels of income.

-Refer to Table 18-5.The tax system is

A) progressive throughout all levels of income.

B) proportional throughout all levels of income.

C) regressive throughout all levels of income.

D) regressive between $20,000 and $25,000 of income and progressive between $32,000 and $42,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Figure 18-1<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Figure 18-1

Q2: Figure 18-6<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Figure 18-6

Q3: Income inequality increases as the Gini coefficient

Q4: Public schools in the United States get

Q5: The largest percentage of federal income tax

Q7: The public choice model<br>A)examines the degree of

Q8: A proportional tax is a tax for

Q9: Most economists agree that some of the

Q10: If official poverty statistics for the United

Q11: If the government wants to minimize the